Maintaining a solid roof isn’t just about avoiding leaks; it’s an investment in our homes’ safety and value. Far from the dramatic changes of a new roof installation, it’s the routine repairs that truly protect and preserve our living spaces. From fixing minor leaks to reinforcing against severe weather, each repair, big or small, plays a crucial role.

This guide will shed light on the importance of these repairs, not only for home maintenance but also for their potential benefits as a tax deduction. Yes, that’s right—staying on top of your roof repairs could offer financial perks at tax time. We’ll explore how these essential roof maintenance efforts could also help lighten your tax load, blending practical home care with smart financial planning.

What is tax deductibility?

Tax deductibility refers to the ability to subtract certain expenses from your taxable income, thereby reducing the amount of income tax you owe. In the context of homeownership and property management, certain costs, including some types of roof repairs, can qualify as tax-deductible expenses. This means if specific conditions are met, the money spent on repairing a roof could lower your taxable income, potentially leading to tax savings.

Understanding which roof repairs qualify and how to claim these deductions is crucial for homeowners and property investors aiming to maximise their financial benefits while maintaining their properties.

When can roof repair be considered tax deductible?

Roof repair can be considered tax-deductible under certain circumstances, primarily focusing on the nature of the property and the reason for the repairs. For personal residences, deductions are typically limited, but repairs resulting from sudden events like natural disasters may qualify. In contrast, for rental properties, roof repair can often be deducted as part of maintenance expenses to keep the property in good condition for tenants.

The key distinction lies in whether the repair is a necessary upkeep or an improvement, with the former being more likely to be deductible. Understanding these nuances is essential for property owners aiming to navigate the tax implications of their roofing expenses effectively.

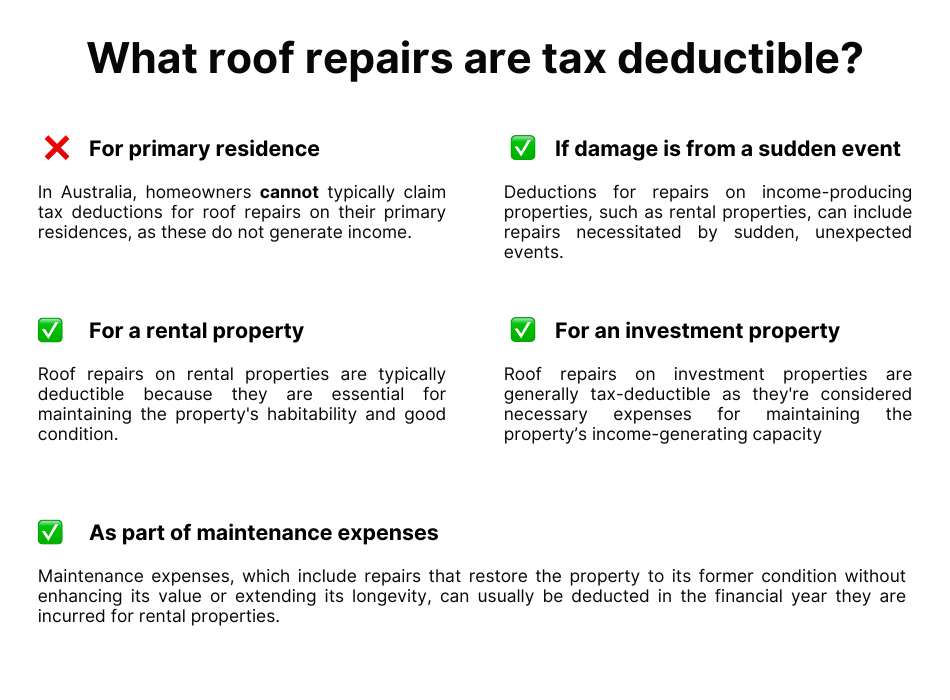

For personal residences

In Australia, homeowners cannot typically claim tax deductions for roof repairs on their primary residences, as these do not generate income. The Australian Taxation Office (ATO) allows deductions for repairs and maintenance only on properties used to produce assessable income, like rental properties.

Therefore, expenses related to maintaining or repairing a personal residence, where the property is not used for income-producing purposes, do not qualify for tax deductions. The exception lies in cases where a portion of the home is used for income-generating purposes, such as a home office. In such instances, a proportional deduction based on the area used for these activities may be allowable. For comprehensive details and the latest updates on what can be claimed, it’s advisable to consult directly with the ATO or a tax professional.

If damage is from a sudden event

In the context of Australian tax law, deductions for repairs on income-producing properties, such as rental properties, can include repairs necessitated by sudden, unexpected events—like storms, fires, or natural disasters. These incidents typically result in damages unforeseen and beyond regular maintenance, potentially qualifying the repair expenditure as an immediate tax deduction.

It’s crucial to differentiate between repairs, which restore the property to its pre-damaged state, and improvements, which enhance the property’s value or extend its life and are depreciated over time.

For personal residences not used to generate income, claiming such deductions is limited. Property owners should consult with tax professionals or the ATO for specific guidance and ensure they adhere to the current tax laws and regulations when claiming such deductions.

For a rental property

Rental property owners enjoy more flexibility regarding tax deductions for roof repairs, recognising these expenses as integral to the property’s upkeep for tenant occupancy. According to Australian tax regulations, roof repairs on rental properties are typically deductible because they are essential for maintaining the property’s habitability and good condition.

These deductions cover a wide array of repair activities, from simple leak fixes to more extensive damage repairs, provided they are carried out to preserve the property’s current value rather than increase it.

ey are carried out to preserve the property’s current value rather than increase it.

For an investment property

In Australia, roof repairs on investment properties are generally tax-deductible as they’re considered necessary expenses for maintaining the property’s income-generating capacity. These deductions can include costs for fixing leaks or damage, provided they are repairs rather than improvements, which aim to restore the property to its original condition. It’s important for investors to keep detailed records of such expenses for accurate tax reporting and to consult with a tax professional to ensure compliance with current tax laws.

As part of maintenance expenses

The distinction between a maintenance (repair) expense and a capital improvement is pivotal in tax considerations for property owners. Maintenance expenses, which include repairs that restore the property to its former condition without enhancing its value or extending its longevity, can usually be deducted in the financial year they are incurred for rental properties.

This approach ensures that the property retains its usability without accruing additional value, a key factor in distinguishing deductible repairs from capital improvements that are subject to different tax treatments.

Property owners must meticulously document these expenses to accurately report them and should seek guidance from tax professionals or consult directly with the ATO to navigate the complexities of tax deductions for property maintenance and improvements effectively.

What conditions must be met for roof repair to be tax deductible?

Understanding the conditions under which roof repairs become tax-deductible is essential for property owners, especially in the context of income-producing properties like rental homes. Let’s delve into these prerequisites, incorporating practical advice and suggestions for relevant documentation.

Must be a repair, not an improvement

The first step in determining the tax deductibility of roof repairs is establishing whether the work done qualifies as a repair rather than an improvement. A repair involves work done to fix damage or wear and tear, aiming to restore the property to its original state. In contrast, an improvement enhances the property’s value, and functionality, or extends its life. For example, replacing damaged shingles due to wear and tear qualifies as a repair, while upgrading to a more durable roofing material for better insulation is considered an improvement.

Repair restores to original condition

For a roof repair to be tax-deductible, it must restore the roof to its pre-damage or pre-wear state without adding to its value or changing its functionality. It’s about maintaining the status quo rather than enhancing the property. This criterion ensures that the work done is aimed at preserving the existing structure.

Must be necessary and ordinary

Deductible repairs must be both necessary and ordinary, meaning they are essential for the property’s upkeep and are common practice in property maintenance. Necessary repairs ensure the property remains safe and functional for tenants, while ordinary repairs are those typically expected in the course of property management. This distinction helps differentiate between routine maintenance and extraordinary work that might fall into the category of improvements.

Ordinary in the business or rental context

In the realm of rental properties, the term ‘ordinary’ takes on a specific connotation. It refers to repairs that are routine for the business of renting out property. This means the expense should be commonly accepted and expected in the rental business, underlining the importance of the repair’s regularity in property management.

Documentation and evidence

Maintaining a comprehensive record of repairs, including invoices, receipts, and before-and-after photographs, is crucial. This documentation supports the necessity and scope of the repairs, providing clear evidence for tax purposes. Keeping detailed records not only aids in claiming deductions but also ensures compliance with tax regulations.

Consultation with professionals

Given the complexities of tax law, consulting with a tax professional or the Australian Taxation Office (ATO) is advisable. They can provide guidance tailored to your specific situation, ensuring you fully understand the conditions for claiming deductions on your tax return and comply with current regulations.

Incorporating these insights and adhering to the outlined conditions will help property owners navigate the tax deductibility of roof repairs more effectively. Always seek professional advice to stay informed about the latest tax laws and to maximise your tax benefits safely.

Leave A Comment